- Introduction

- Understanding Forex CRM in Prop Firms

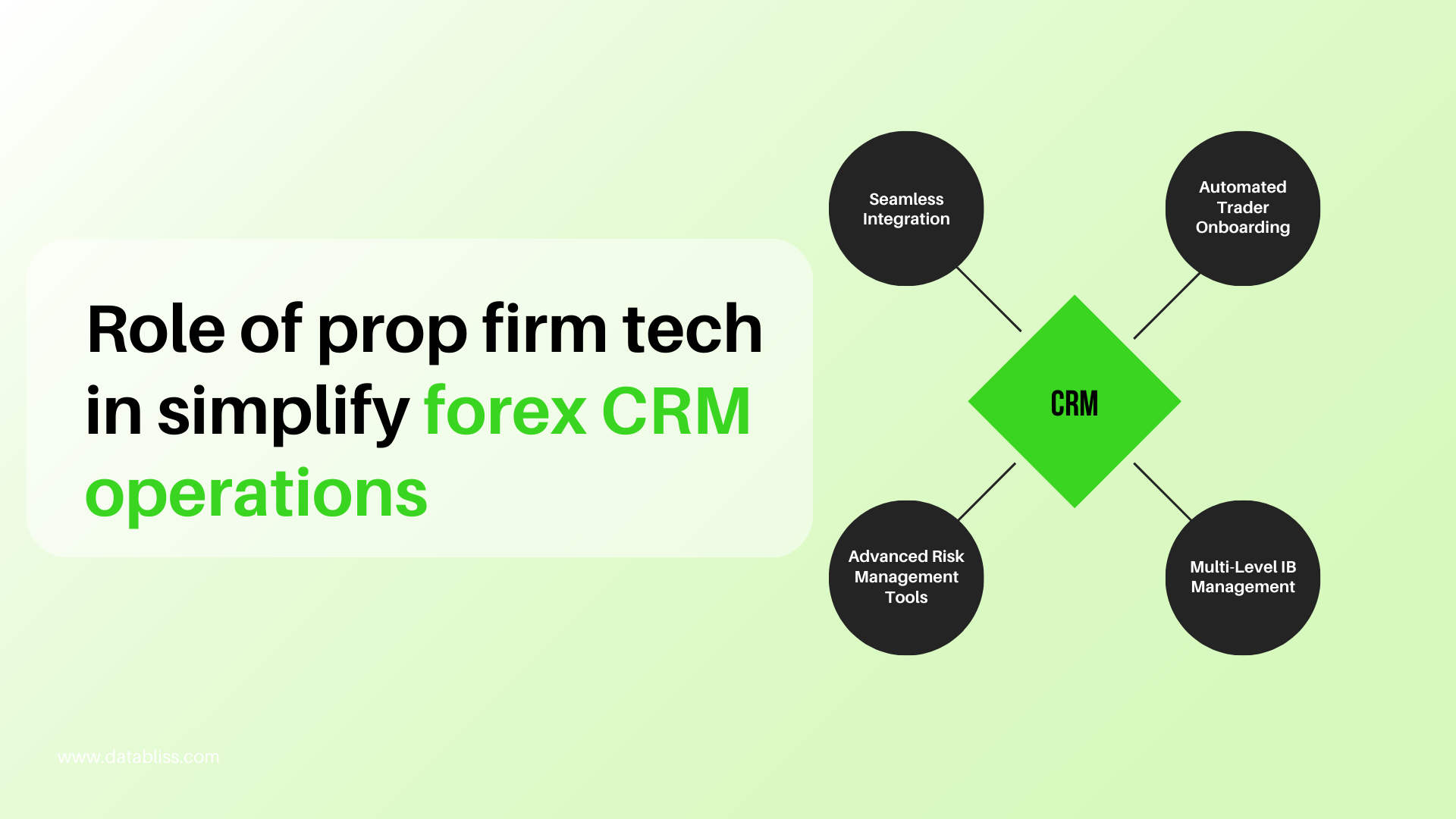

- Key Benefits of Prop Firm Tech in Forex CRM Operations

- 1. Seamless Integration with Trading Platforms

- 2. Automated Trader Onboarding & KYC Compliance

- 3. Advanced Risk Management Tools

- 4. Automated Performance Tracking and Payouts

- 5. Enhanced Communication and Support

- 6. Multi-Level IB (Introducing Broker) Management

- 7. Customizable Dashboards and Reporting

- The Future of Prop Firm Tech in Forex CRM

- Conclusion

Introduction

The rise of cutting-edge technological solutions has grown as a result of the growth of proprietary trading firms, or prop firms, in the forex sector. These include Forex CRM (Customer Relationship Management) solutions, which are essential for managing traders, optimizing processes, and guaranteeing smooth communication. Nevertheless, conventional CRMs frequently fail to satisfy the unique requirements of prop enterprises. Prop Firm Tech can help with this by providing customized solutions that streamline CRM processes, increase automation, and boost productivity.

Key Takeaway points

- Prop firm tech automates Forex CRM operations with seamless trading platform integration.

- Advanced risk management tools ensure secure trading and automated payouts.

- AI and blockchain innovations enhance CRM efficiency and scalability.

Understanding Forex CRM in Prop Firms

Because it makes trader account management, performance tracking, risk monitoring, and customer support easier, a Forex CRM is essential for legitimate trading businesses. Unlike the conventional CRM systems used by typical brokerage firms, forex CRM for prop firms must offer sponsored trader programs, performance statistics, payout automation, and risk management features.

Traditional CRM solutions are often incompatible with risk management tools, funding evaluation systems, and specialized trading platforms. As a result, Prop Firm Tech has changed how Forex CRMs operate.

Key Benefits of Prop Firm Tech in Forex CRM Operations

1. Seamless Integration with Trading Platforms

Real-time connectivity with trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and other proprietary trading solutions is made possible by Prop Firm technology. By ensuring that trader data moves seamlessly between the trading system and CRM, this integration lowers the possibility of human input errors and boosts operational effectiveness.

2. Automated Trader Onboarding & KYC Compliance

Prop firm CRMs with cutting-edge technology provide automatic trader onboarding and Know Your Customer (KYC) verification. Businesses may swiftly confirm trader identities by integrating with third-party KYC services, guaranteeing regulatory compliance and lowering the possibility of fraudulent activity.

3. Advanced Risk Management Tools

Prop Firm Tech integrates automated risk management technologies to improve CRM functionalities. These tools assist businesses in enforcing trading limits, applying automated risk controls, and monitoring traders’ risk exposure. This permits traders to work within predetermined parameters while guaranteeing the protection of the company’s cash.

4. Automated Performance Tracking and Payouts

Monitoring trader performance and effectively handling compensation are two of prop firms’ biggest challenges. This is made easier by proper firm CRMs, which automate performance statistics, assess traders’ profitability, and guarantee that profit splits are computed precisely. Businesses can lower administrative expenses by establishing preset payout schemes.

5. Enhanced Communication and Support

Through the integration of CRM solutions with email, live chat, and ticketing systems, appropriate business technology facilitates centralized communication. This guarantees smooth communication between support staff and traders, which enhances trader satisfaction and problem solving.

6. Multi-Level IB (Introducing Broker) Management

Effective affiliate and IB management systems are provided by forex CRM solutions that are coupled with prop firm tech. This feature promotes business growth through partnerships by enabling prop businesses to organize commissions, track referrals, and give partners comprehensive reporting.

7. Customizable Dashboards and Reporting

CRM systems for prop firms provide real-time reports and dashboards that are specifically designed to meet the requirements of proprietary trading organizations. These dashboards assist businesses in making data-driven decisions by offering insights into trader performance, account status, and financial activities.

The Future of Prop Firm Tech in Forex CRM

The future generation of Forex CRM solutions is being shaped by the development of blockchain technology, AI-driven analytics, and machine learning. As prop firm technology develops further, businesses will gain from:

- Trading insights driven by AI to evaluate trader conduct

- Transparency through blockchain-based transaction security

- Cloud-based CRM programs for increased scalability and accessibility

- Models for automated risk assessment to improve risk management techniques

Conclusion

The importance of Prop Firm Technology in simplifying Forex CRM processes cannot be emphasized. Using advanced automation, risk management tools, seamless interfaces, and real-time data, proprietary trading firms can increase productivity, minimize manual effort, and improve trader experience. As the forex prop trading sector expands, investing in the proper prop firm technology will be critical for firms trying to scale and stay competitive.