How Do Prop Firms Make Money?

The forex trading industry is dynamic and competitive, with Proprietary Trading Firms (Prop Firms) such as FTMO and My Forex Funds offering traders a unique opportunity to access significant funds and potentially earn substantial profits.

Have you ever wondered how proprietary firms earn money?

Key Takeaway points

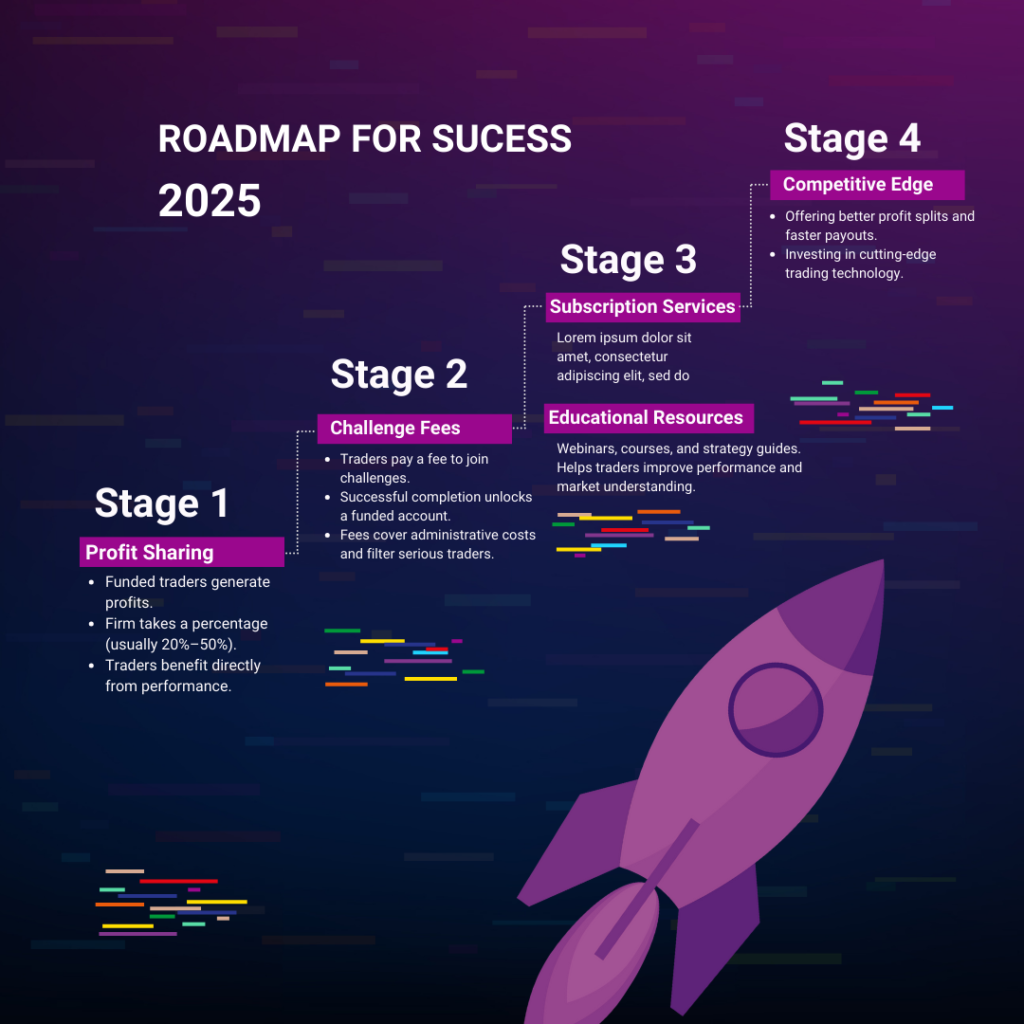

- Profit sharing is how prop businesses generate money; they take a percentage of traders’ gains.

- Challenge fees serve to filter out genuine traders and produce consistent income.

- Offering subscriptions and instructional resources increases revenue and enhances trading performance.

Understanding prop firms’ business models is just as crucial as honing your trading technique. Prop firms make money primarily from trading profits, challenge fees, and extra services such as training and subscription-based tools. This diverse revenue structure enables it to remain competitive in the volatile world of FX trading.

How Do Prop Firms Make Money?

Proprietary trading firms, commonly known as prop firms, primarily earn revenue through:

1. Profit Sharing: A Win-Win Model

Profit sharing is at the heart of most real estate firms’ business models. This is how it works.

- Prop firms fund traders’ accounts, allowing them to trade with the firm’s capital.

- When traders make profits, the business takes a share of those profits, which typically ranges between 20% and 50% depending on the firm’s structure.

This strategy fosters a mutually beneficial collaboration in which both the trader and the firm profit from successful trading.

- Profit-sharing pushes traders to do their best because their profits are directly related to their success.

- Firms use risk management policies (such as drawdown limitations and profit targets) to preserve their capital and maintain long-term profitability.

- A transparent and equitable profit-sharing mechanism attracts skilled traders, improving the firm’s competitive position.

2. Challenge Fees: Filtering Out Serious Traders

To evaluate potential traders, many prop businesses utilize a trading challenge approach.

- In order to participate, aspiring traders must pay a challenge fee.

- The fee serves as a filter, identifying committed and talented dealers.

- If the trader reaches the challenge’s profit and risk targets, they will be granted a funded account.

- Even if traders do not qualify, challenge fees offer prop firms with a consistent source of revenue.

- Fees assist to cover administrative costs and ensure that only motivated traders join the firm’s ecosystem.

- Some firms reimburse challenge fees if the trader reaches performance criteria.

3. Subscription Services and Educational Resources

To diversify revenue streams, several prop businesses provide subscription-based services and training resources to assist traders develop their abilities and remain competitive.

- Cutting-edge trading platforms, real-time market analysis, and proprietary tools.

- Trading signals, market intelligence, and algorithmic trading help.

- Educational materials include seminars, video lessons, and strategy guides.

Subscriptions provide a consistent revenue and enhance trader performance.

Access to exclusive resources helps traders stay competitive.

Some firms provide 1-on-1 coaching and mentorship programs to help traders improve their skills.

Profit Sharing + Challenge Fees + Subscriptions = A Sustainable Model

Profit sharing, challenge fees, and subscription services combine to provide a long-term business model for property firms.

- Profit sharing guarantees that businesses profit from the success of their dealers.

- Challenge fees generate quick financial flow and assist to weed out less serious players.

- Subscription services generate recurring revenue while improving trading performance.

This multi-stream architecture enables prop enterprises to remain profitable even in unpredictable market situations, ensuring stability and growth.

Beyond Revenue: Building a Competitive Edge

Prop businesses are concerned with more than just making money; they also want to create a strong trading network and improve their market competitiveness.

- Creating a community of expert traders helps the firm’s reputation and attracts top talent.

- Networking events, strategy-sharing sessions, and mentorship programs assist traders improve their expertise.

- A collaborative environment benefits the firm since traders may share information and develop new techniques.

A robust trader community improves the firm’s brand reputation and generates a positive feedback loop for growth and success.

Firms that cultivate long-term relationships with their traders frequently have higher retention rates and improved trading performance.

Choosing the Right Prop Firm: A Two-Way Street

When choosing a prop firm, consider these crucial aspects.

Profit-Sharing Structure: Look for companies that have a fair and transparent profit-sharing plan.

- Challenge Process – Make sure the challenge terms are clear and doable.

- Trading Tools – Evaluate the trading platform and accessible tools.

- Risk Management – Ensure that the firm’s drawdown limits and profit targets are consistent with your trading style.

- Community and Support: Assess the firm’s support system, mentorship programs, and trader network.

Hint: Read other traders’ reviews to gain an intimate look at the firm’s dependability and overall experience.

How Prop Firms Stay Competitive

To succeed in the extremely competitive prop trading business, firms must continue to innovate and adapt.

- Investing in FX technologies to help proprietary trading firms improve trading efficiency and automation.

- To recruit elite staff, consider offering fair profit shares and speedier payout cycles.

- We offer cutting-edge trading platforms with AI-driven market analysis and automated trading features.

To remain competitive in the prop firm market, a balance must be struck between providing value to traders and ensuring the business’s profitability through smart risk management and modern technologies.

Conclusion

Understanding how prop firms create money allows traders to align their ambitions with the firm’s structure. Successful deals benefit both the firm and the trader, resulting in a win-win situation.

- Partnering with a renowned prop provider gives you access to:

- Capital for trading and cutting-edge technology

- Expert advice and support

- A network of expert traders.

In the forex market, success is more than just generating money; it is also about adjusting, learning, and improving. With the correct prop business, you can achieve new heights of success in the competitive world of FX prop trading.

Leave a Reply