BLOGS

The Future of Prop Firms: Tech Providers, Demo Contests & Rising Competition in 2025

By providing traders with access to funds in return for a cut of the earnings, proprietary trading firms, and prop firms, have grown to be a powerful influence in the trading sector.

Earn to Trade with Instant Funding and Take Your Next Step Funded

Traders can begin using actual funds right away thanks to instant financing prop firms, which do away with lengthy evaluation procedures. Earn to trade by concentrating on disciplined tactics, risk management, and consistency.

Are prop firm challenges hard?

Proper risk management is crucial: Controlling drawdowns and controlling position sizes might boost your chances of passing a prop firm challenge. Choosing the Right Prop Firm Matters – Different businesses follow different guidelines.

Top unregulated forex brokers in 2025

Regulated brokers are highly valued by forex traders, and with good reason—they are typically safer. However, because unregulated brokers might occasionally provide greater freedom, such as greater leverage and access to fewer limited assets, some traders continue to consider them.

How to Successfully Prepare for a Prop Firm Trading Competition

Prop firm trading tournaments have become a popular tool for traders to demonstrate their abilities, verify their profitability, and seek investment from proprietary trading businesses. These competitions put traders’ risk management skills to the test, as well as their ability to execute strategies effectively.

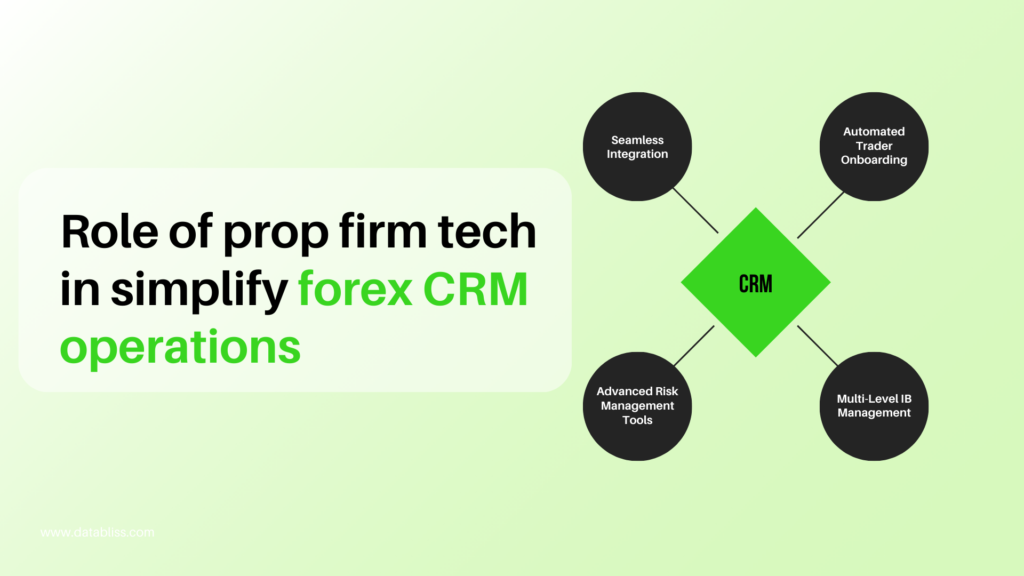

The role of prop firm tech in simplify forex CRM operations

The rise of cutting-edge technological solutions has grown as a result of the growth of proprietary trading firms, or prop firms, in the forex sector. Prop Firm Tech can help with this by providing customized solutions that streamline CRM processes, increase automation, and boost productivity.