With digital platforms allowing for greater innovation and globalization of trading services and activities, the brokerage service sector is always changing.

In the financial markets, proprietary trading is gaining popularity. It differs from current market trends due to its demanding nature and distinctive features. Prop trading is a very lucrative business since more investors are requesting its services.

The 2020 valuation of this niche market was $6.7 billion, and between 2021 and 2028, it is anticipated to expand at a CAGR of 4.2%. More astonishingly, between 2020 and 2024, the phrase “prop trading” saw a tremendous 8,409% spike in search volume.

So, what all this hype is about, and how to start a prop firm successfully?

Key Takeaways

- A brokerage platform known as a proprietary trading firm gives investors the opportunity to trade on the company’s behalf by utilizing its funds and resources following the completion of specific tasks.

- Before trading with the broker’s own funds and resources, professional traders take part in prop company contests to finish particular investing tasks.

- Integrating a technology solution, liquidity, legal licensing, and marketing calls for a substantial financial commitment and meticulous planning when starting a prop trading business.

Understanding Prop Trading

When a financial organization invests in the market and makes money using its resources and capital, this is known as proprietary trading. Instead of providing brokerage services, this model calls for the organization to trade a variety of financial products and asset classes.

Traditionally, brokerage houses use the money of their customers to invest in other markets and earn money through commissions and other expenses. On the other hand, the institution employs its prop fund to boost its wealth through proprietary trading.

The prop firm can either recruit experienced investors to trade on its behalf or utilize its own brokers to make market investments.

| Prop Firm | Traditional Firm |

| Utilizes the company’s funds | Use the client’s funds |

| Policies for risk management to safeguard assets | Whether you make money or not, profits |

| Only makes money when everyone makes money. | Will probably advise you to withstand the storm in a depressed market. |

Can you Start a Prop Firm?

Brokerage companies that already exist can either establish a prop trading solution from scratch or integrate a prop trading system to create a new business line and boost their revenue.

Brokers must, however, set a number of goals when recruiting seasoned investors in order to identify the best experts with years of expertise and cutting-edge abilities.

The difficulties include a number of investing goals, including reaching predetermined returns, doubling the allocated cash, and preventing losses that exceed a set threshold. To be eligible to use the firm’s cash, resources, and software and split the profits with the broker, investors must pass the challenges with quick and accurate decisions.

Are Prop Trading Firms Profitable in 2025?

Brokers have greater opportunity to profit from prop trading. They can take a portion of the difficult traders’ actions by putting profit-sharing arrangements into place. Those that meet the goals and trade with the company’s resources can also receive a portion of the profits.

Brokers can also charge a fee to enter the competition, and those who fail to meet their targets might pay to retake it.

Advantages of Establishing a Private Trading Company

Starting a prop firm company is a profitable idea for a variety of reasons. These are the benefits of proprietary trading, whether it is done as a stand-alone venture or as an extension of an already-existing brokerage firm.

Income Diversification

You may reach new markets, more customers, and additional revenue streams by launching a prop trading solution. In proprietary trading, there are various models of profitability.

You can make money by charging new participants and those who wish to retake the challenge an admission fee. As the trader tries to accomplish their goals, you can get investment profits from their activity. Some objectives can be to double a certain amount of capital in real markets or invest in expanding markets.

After hiring investors who successfully finish their tasks, you may use a variety of profit-sharing strategies to profit from the trader’s operations. However, you can use profitable trading techniques to generate investment templates that you can then market as copy-trading tactics.

How Much Money You Need to Start a Prop Firm?

The target market in which you are starting your prop trading firm and the license required for lawful operation determine the costs.

Integrating a prop trading system will take up a considerable amount of your budget. The features provided, trading software, challenge tracking, and customer acquisition program all affect this price. An annual fee might range from $10,000 to $50,000.

You will then need to pay for the license and submit an application to become a legitimate financial service provider. Prop trading may not have specific licensing requirements, but as a brokerage firm, you must obtain a specific financial license, which can cost up to $10,000. Additionally, certain countries may demand that you have an initial operating capital in your bank account. This is a financial necessity that you must take into consideration, but it is not really a cost that you must pay.

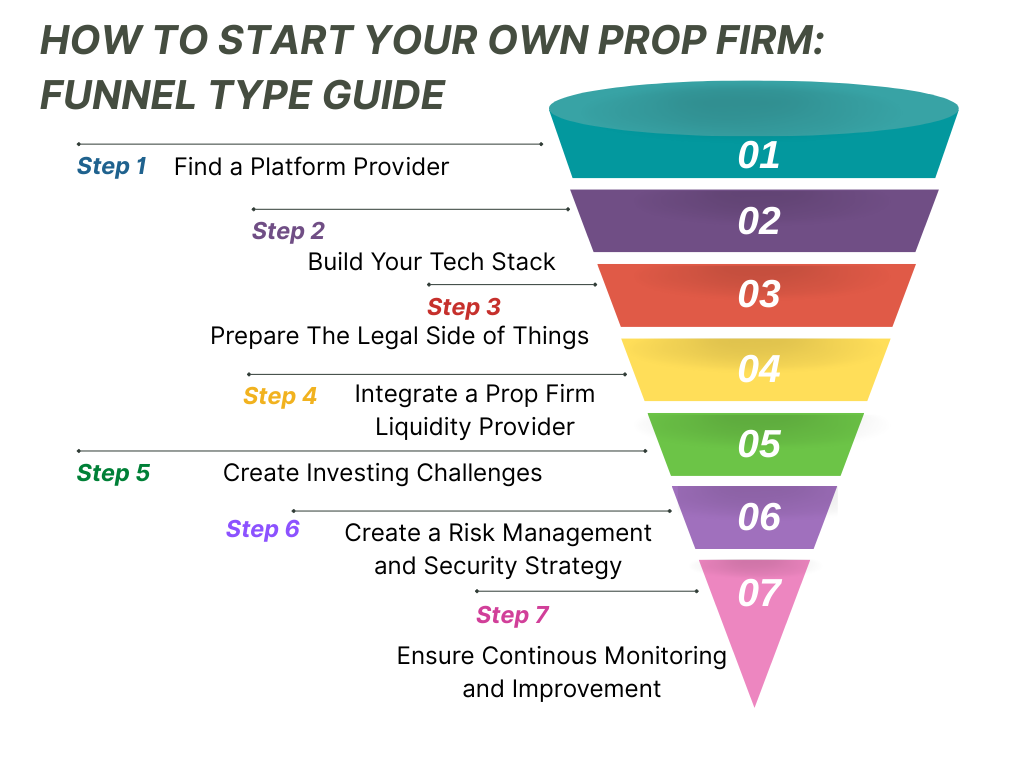

How to Start a Prop Firm From Scratch: Step-by-Step

1. Find a Platform Provider

A technology provider that can give you with the prop trading platform that best meets your needs is the first thing you need. Access to financial markets, trading software, acquisition programs, and a challenge template maker will all be part of the prop solution.

These components make up the main trading activities that draw in investors, create challenging investment assignments, track traders’ performance in real time, and guarantee flawless order execution.

The prop trading solution that is selected must guarantee flexibility in terms of choosing profit-sharing options, posing problems, and conducting transparent evaluations.

2. Build Your Tech Stack

Once you secure the trading platform for your prop trading activities, you must develop and integrate other technologies to support your system. These services include payment systems and crypto payment gateways to allow investors to withdraw their revenues using the preferred method.

You can also integrate a legal compliance tool like a KYC verification plug-in to conduct client background checks. You must also configure the hosting service provider for data storage and database structure.

To support your clients, you will require a customer service package that includes live chat, chatbot, and e-mail. Social trading and copy trading are rising in popularity among trading venues, which you can also support to enable investors to copy and create copies of their trading systems.

3. Prepare The Legal Side of Things

The financial regulator may demand starting cash, board member background checks, or financial suggestions, depending on your business. It may take weeks or months to process these paperwork, so hire a legal team and get them ready in advance.

While obtaining a prop trader’s license may not be required, operating as a financial brokerage service provider requires obtaining a business authorization. To protect your traders’ money, you also need to present an anti-money laundering protocol and risk assessment techniques.

4. Integrate a Prop Firm Liquidity Provider

Finding liquidity for your own prop trading business is essential. Access to financial markets for a range of asset classes and products is made possible by the liquidity partner. Finding a prop liquidity provider that links you to the widest variety of stock exchanges, tradeable securities, liquidity venues, and more is therefore essential.

You may provide the finest trading circumstances, such as narrow spread ranges and cheap transaction costs, by increasing the liquidity of your platform.

Verify your provider’s liquidity coverage, examine their liquidity aggregation and distribution procedures, and make sure they have relationships with several reputable venues to give the greatest trading circumstances.

5. Create Investing Challenges

Your prop firm’s trading issues are essential components. To guarantee that only the top investor with an effective trading strategy joins your company as a prop investor, create competing tasks that are both reasonable and difficult.

Choose a prop trading solution that lets you measure, monitor, and customize real-time performance when selecting one for your company. For challengers to easily navigate, select, and monitor their progress, it is essential to have an accessible structure with straightforward user interfaces.

Establish pricing strategies for taking part in and retaking the prop challenges, the funds given to prop investors, and the profit-sharing program for profitable traders.

6. Prepare a Marketing Strategy

Because prop firms focus on a certain market sector, a proprietary trading platform incurs lower marketing costs than retail brokers. A multi-asset brokerage firm, on the other hand, has a wider target market, which results in higher expenses for promotions, ads, and social media campaigns.

Prop brokers use specialized channels, such online communities and referral programs, where experienced investors are accessible to concentrate their resources.

To encourage other companies and institutional investors to recommend other traders to your platform in return for a commission, you can introduce broker and affiliate marketing tactics.

7. Create a Risk Management and Security Strategy

To lessen the impact of prop traders’ dangerous tactics, pick a platform that provides a range of risk control tools. These tools also assist applicants in simplifying their goal accomplishments and precisely planning their trading strategy.

To reduce exposure to unforeseen market moves, particularly in extremely volatile markets and assets, you can offer maximum drawdown risk limit, cash daily risk limit, cash loss risk limit, and loss-limit orders.

8. Ensure Continous Monitoring and Improvement

To guarantee consistent platform performance and prevent service outages, conduct routine technical inspections and internal audits. This entails thorough software testing prior to platform launch and real-time system monitoring to promptly detect and fix issues.

To stay competitive, use the back-office CRM analytics to make service improvements based on client preferences and comments.

Conclusion

If you know how to create a prop firm from scratch, including locating the best trading software supplier, liquidity provider, and technology partner, you may make a lot of money from a proprietary trading business.

To build the challenges, design the profit-sharing arrangements, and draw in seasoned investors to your platform, this endeavor necessitates a substantial investment and meticulous planning.

Our 08 step strategy will help you start the best prop firm and take advantage of the expanding industry trends.