Running a successful proprietary trading firm today requires more than just capital and traders. It needs advanced prop firm software that can scale operations, ensure compliance, and manage risk in real time. Over the past seven years, I’ve worked with many prop firms. I have seen how the right admin panel can significantly impact a firm’s ability to grow sustainably.

The Evolution of Prop Firm Technology

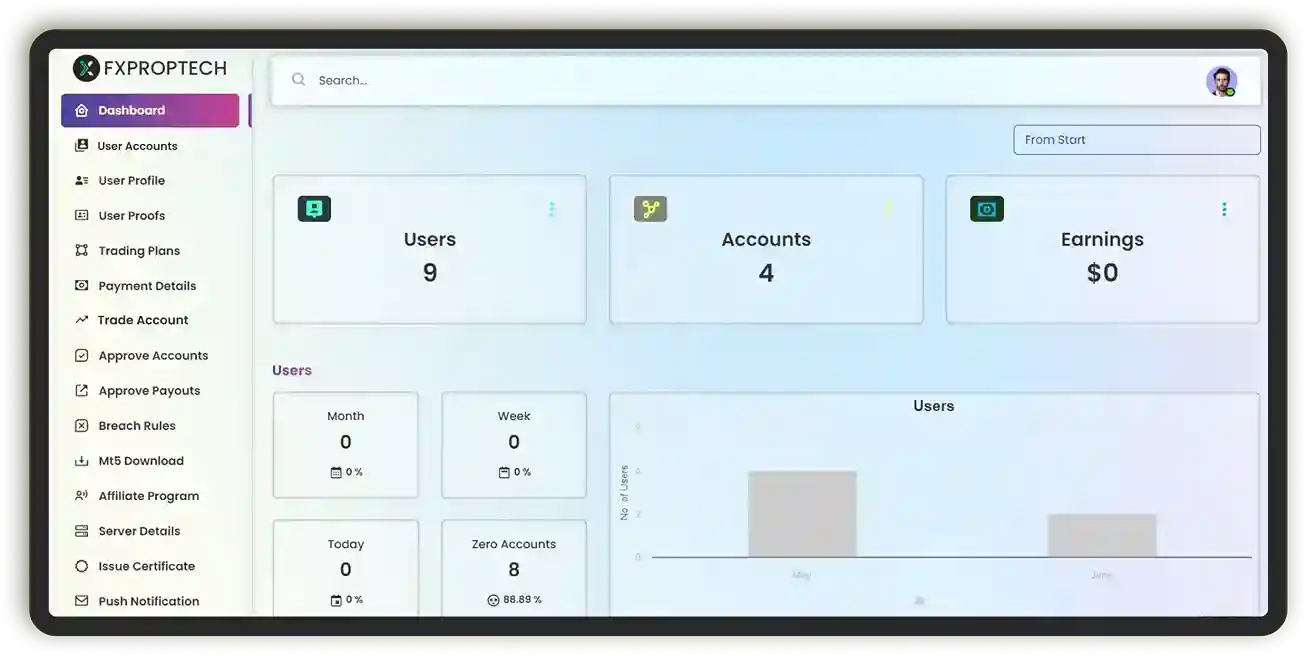

The proprietary trading industry has matured quickly. What began as manual spreadsheet tracking has changed into detailed prop firm admin panels that automate everything from onboarding traders to distributing profits. Modern prop firms process thousands of evaluation requests each month, so automated systems are essential for efficiency.

Essential Admin Panel Features for 2025

- Automated Trader Evaluation and Challenge Management

The core of any prop firm CRM lies in its capacity to manage evaluation programs at scale. Leading firms now handle over 10,000 challenge purchases each month, making manual handling impossible. Your admin panel must include:

- Automated phase progression: Traders advance automatically when they meet profit targets and risk parameters.

- Configurable evaluation rules: Daily drawdown limits, profit targets, and scaling plans customized to your business model.

- Real-time compliance monitoring: Instant alerts for when traders approach or exceed risk thresholds.

- Risk Management and Real-Time Monitoring

Effective risk control distinguishes successful prop firms from those that fail. Your prop firm dashboard needs advanced risk management tools that work in microseconds, not minutes:

- Dynamic risk thresholds: Flexible daily and maximum drawdown limits that adjust based on account size and trading history.

- Automated position closure: Immediate trade termination when risk parameters are breached.

- Multi-asset risk aggregation: Risk assessment across forex, indices, and commodities at the portfolio level.

A European prop firm reduced monthly losses by 30% after implementing automated risk controls in their admin system.

- Streamlined KYC/AML and Compliance Automation

Regulatory compliance has become more complex, with jurisdictions like the FCA and CySEC enforcing stricter rules. Your admin panel must include:

- Automated identity verification: Integration with providers like Sumsub for quick document processing.

- Real-time transaction monitoring: AI-powered systems that identify suspicious trading patterns.

- Jurisdiction-specific compliance rules: Automated workflows that adjust to local regulatory needs.

Modern AI systems for compliance can cut fraud detection time by up to 70%, enabling faster onboarding while maintaining security.

- Comprehensive Trader and Account Management

Managing hundreds or thousands of traders requires strong CRM capabilities directly in your admin panel:

- Centralized trader profiles: Complete trading history, performance metrics, and communication logs.

- Automated account provisioning: Instant demo and live account creation once evaluations are complete.

- Communication management: Built-in messaging systems with automated alerts for rule violations, profit targets, and payout approvals.

- Payment Processing and Payout Automation

Manual payout processing creates delays and dissatisfaction among traders. A New York-based prop firm saw a 20% increase in trader satisfaction after implementing automated payouts:

- Multi-gateway payment processing: Support for credit cards, crypto, and local payment methods.

- Automated profit calculations: Real-time calculations of splits based on your firm’s structure.

- Instant payout approvals: Quick withdrawal processing with automated compliance checks.

- Analytics and Performance Tracking

Making data-driven decisions needs comprehensive analytics built into your prop firm software:

- Trader performance metrics: Pass rates, average profitability, and risk-adjusted returns.

- Business intelligence dashboards: Tracking revenue, conversion rates, and operational KPIs.

- Predictive analytics: AI insights that identify promising traders and risk patterns.

Integration and Scalability Considerations

Your admin panel should integrate smoothly with trading platforms, payment processors, and third-party services. Look for solutions that provide:

- MT4/MT5 native integration: Direct connections to MetaTrader platforms for real-time data flow.

- API-first architecture: Flexible links to payment gateways, KYC providers, and marketing tools.

- Cloud-based scalability: Infrastructure that expands with your trader base without losing performance.

The Competitive Advantage

Prop firms using advanced admin panels report notable improvements in operations: 40% faster trader onboarding, 60% less manual compliance work, and 30% lower operational costs. These gains lead to competitive advantages in acquiring and retaining traders.

Implementation Best Practices

When choosing your prop firm admin panel, focus on solutions that offer:

- Proven track record: Technology that has already helped successful prop firms worldwide.

- Comprehensive support: Expert implementation teams and ongoing technical help.

- Regulatory compliance: Built-in features for major jurisdictions where you plan to operate.

- Customization capability: Flexibility to adjust workflows to your unique business model.

The proprietary trading industry continues to change quickly as new regulations, market conditions, and trader expectations emerge. Your admin panel should be more than functional. It should be your tool for scaling operations, managing risk, and providing excellent trader experiences.