- Introduction

- What is an FX Prop Firm?

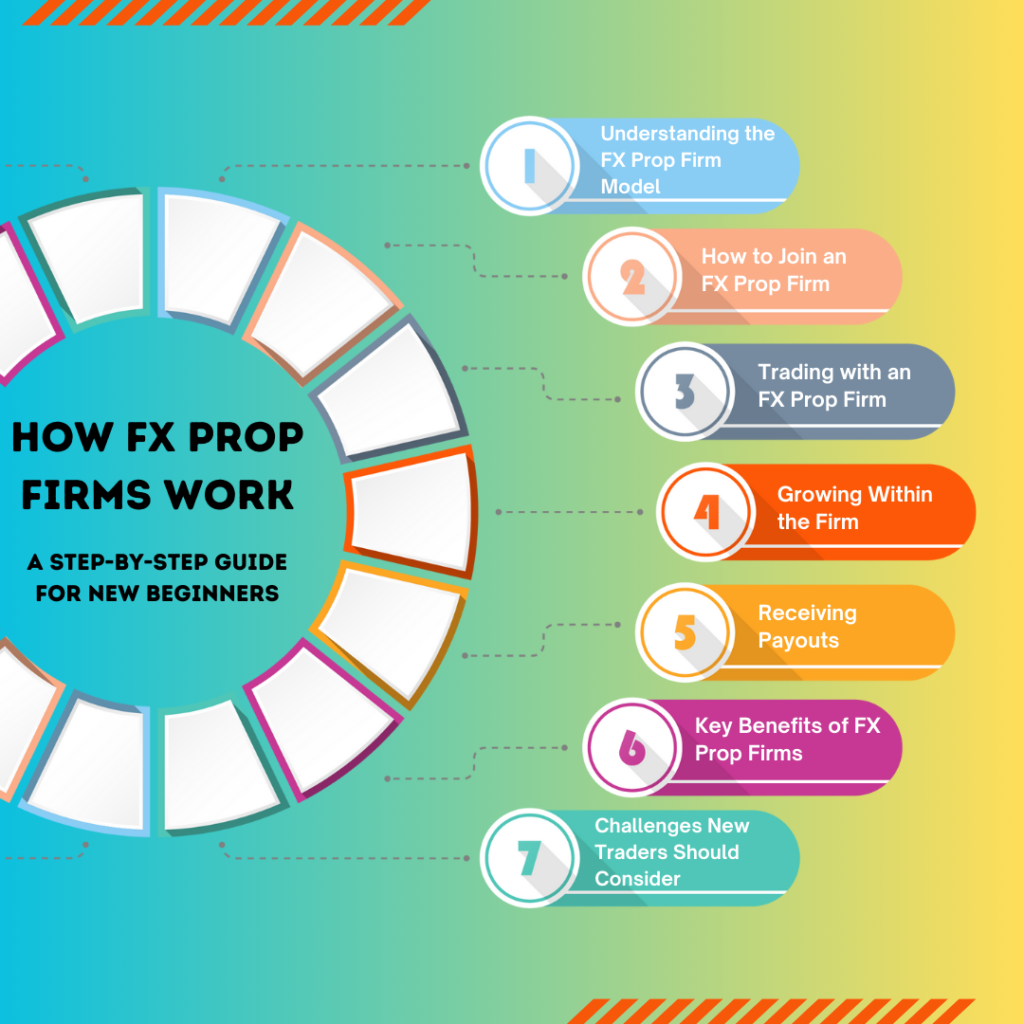

- Step 1: Introduction to FX Prop Firm Model

- How to Enter the FX Prop Firm

- Phase 3: Evaluation of Trading Account with a Live Prop FX Firm

- Step 4: Profiting within the company

- Step 5: Getting Paid

- Advantages of FX Prop Firms

- Challenges New Traders Should Consider

- Conclusion

Introduction

Trading on the forex market can be very intimidating for new traders with small capital to risk. Now, FX prop firms; or foreign exchange proprietary trading firms, step in and act as a great solution for new and seasoned traders in equal measure, giving access to the capital to be traded without risking their capital. It has been a golden opportunity for many traders to build up their skills, grow their capital, and make high profits.

In this guide, we will take you through each step of how FX prop firms operate and what you need to do to join one and succeed.

What is an FX Prop Firm?

An FX prop firm is a proprietary trading firm that deals with forex markets. They provide the capital required for trading in the forex market in return for a share of the profits. Essentially, the firm funds the traders with a certain amount of capital and expects returns while following certain risk management rules.

Prop trading firms differ from other brokerages because, instead of giving market access, they give the ability to provide capital and manage risks for the benefit of traders. This way, instead of working with their money, the traders trade on the firm’s funds, getting to divide only the profit gained in the process. Therefore, a lot of traders get interested, especially newbies who have no savings and might get lost during risky business operations.

Step 1: Introduction to FX Prop Firm Model

Profit-sharing model:

Traders receive funded capital; in turn, they share profits with the firm.

Here is how the model usually works:

Funding and profit sharing: The trader receives the capital after meeting initial requirements like passing an evaluation or showing trading skills. Usually, the profit is split between the firm and traders in percentages such as 70/30 or 80/20 in favor of the trader.

Risk Management:

To safeguard capital, all prop firms have strict risk management criteria. The accounts are bound to daily drawdown limits and monthly drawdown limits. A trader cannot spend more on any particular day than is drawn down. In this sense, the firm’s money is saved, and, in turn, many lessons about trading appropriately are learned.

No-Risk Capital for Traders:

Perhaps the most attractive feature for beginners, the traders do not risk their own capital. They only have to follow the rules and generate profits; all losses are absorbed by the firm, not the trader’s account.

How to Enter the FX Prop Firm

Entree in the FX prop firm does take a step or two which has the intent and a guarantee to finance the prop trading with someone having good skill for the efficient management of risks, obtaining constant profit generation, through which consistency will be reached. That’s what will happen to the potential customer and his financial benefits

Finding the Right Firm:

You should start by looking for firms that fit your trading style, capital requirements, and goals. Every firm has its rules, funding options, and profit splits. Some are better suited to scalping, while others prefer longer-term trades.

Most companies require the traders to undergo the evaluation or demo trading phase. This enables the company to assess the practical skills of the trader. Ensuring that he/she reaches the set profit targets that the firm has in place strictly within the set drawdown limits.

The profit targets and drawdown limits are also the conditions of the evaluation stage, such as reaching certain profit targets like 8-10% within a specified time period while remaining within the limits of drawdown. Profit targets are tough but achievable if done with discipline.

Registration and Requirements:

One thing associated with the signup procedure is filling in tons of paper, identity proof, and a fee paid just for getting this process done. Subsequently, upon having gotten your account opened with such registration, you’re set with access to live evaluation trade.

Phase 3: Evaluation of Trading Account with a Live Prop FX Firm

Subsequently to the passing process you now get access with this company’s fund through evaluation in order to engage in trading live with a firm. That is how to stage what live trading consists in this article:

Getting Funded:

Once you pass through the evaluation, you get funded from a firm’s capital program, and you can get as little as $3,000 or as high as several hundred thousand dollars based on their rules and performance.

Trading Platform and Tools:

Most of the FX prop firms allow access to the most widely used trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) or proprietary software. It includes tools for technical analysis, market indicators, and much more to guide you to the right decision.

Daily and Monthly Targets:

Prop firms generally provide targets in terms of profit achieved for each day and each month. It is the only way you can attain such profit targets within defined limits of risk, thus helping you maintain your funded account and get higher capital allocations.

Adherence to Rules:

Of course, every company will have a set of house rules when it comes to risk management, so things like daily and maximum drawdown limits apply. A good trader needs to stay alert to these rules because drawing too far past them might void funding.

Step 4: Profiting within the company

After agreeing to the initial capital, you can trade and look for ways to scale up the company. That isn’t easy, however since most FX prop companies employ scaling systems that award successful traders with more funds over time. How you do that is;

Scaling Programs:

Professional traders are often permitted the potential of more and more capital. For example, after you have run through several consecutive months with a return, it could be doubled or incremented by some percent.

Assistance and Resources:

Additionally, to further support trader development, companies may be willing to provide webinars, coaching sessions, or a link to strategy resources designed to enhance the skills used in trading and support trader further development.

Performance Reviews:

Most prop firms review traders’ performances. Continuous profitability and observance of the rules may provide for more favorable trading terms or increased capital allocations, moving you ahead more quickly.

Step 5: Getting Paid

One of the best things about being with an FX prop firm is getting your share of profits. Here’s how payout works:

Profit splits:

After the profit is made, the company splits it with the owner according to the agreed percentages, which are usually set at 70/30 and 80/20 percentages in the trader’s favor.

Payout frequency:

The company will often agree on a monthly or bi-weekly payout and payments are mostly made in the form of bank transfers, PayPal, and other forms of digital payments.

Withdrawal of earnings:

Companies can have a policy toward withdrawal in the form of a waiting period or a minimum payout threshold. Having awareness of these policies will ensure that withdrawals are smooth and timely.

Advantages of FX Prop Firms

Many advantages make one attracted to FX prop firms, especially if one is a beginner and looks forward to trading without using money from his pocket.

Any trader can access capital since this is an amount of money, which otherwise cannot be obtained individually.

It reduces the risks associated with trading for individual persons since the trader is now trading other people’s money as opposed to risking his/her money. That is why it is best suited for training purposes.

Professional Development:

Prop firms in FX provide a structured environment that helps the trader cultivate discipline, analytical skills, and risk management abilities.

Career Advancement Opportunities:

Through working with a prop firm, traders can gain valuable experience that opens doors to more opportunities. Such as advanced prop trading roles or independent trading.

Challenges New Traders Should Consider

Although prop trading in FX has a good opportunity, there is still a challenge for all of them. New traders will consider the following things before they start trading with these firms.

Pressure of Targets:

Maintaining the targets while respecting the limits can be stressful, particularly to a beginner.

Learning Curve for Beginners:

Prop trading demands a certain skill, discipline, and sticking to strict rules that would overwhelm a beginner at the initial stages.

Prop firms have explicit rules in terms of trading styles, lot sizes. And even the amount of risk in their accounts, so adaptation to such rules is not very difficult. And traders usually must be quite strict.

Conclusion

FX prop firms open a world of opportunities for beginners who want to trade forex without risking their own funds. By following each step outlined in this guide understand the prop firm model. By joining a reputable firm, trading responsibly, and growing within the firm—you can successfully build your career as a forex prop trader. Remember, the journey requires discipline, a solid trading plan, and consistent performance. If you’re ready to take the next step, research reputable FX prop firms. Consider joining an evaluation program to get started.